Although the median home sales price rose in the 2nd quarter to a historic high, the gain was smaller than the increase in Google buyer lead prices. This caused the CINC Google Real Estate Lead Value Index to decrease slightly from the 1st quarter (you can download the full updated Q2 2022 Google Real Estate Lead Value Index Report here).

The Lead Value Index for the second quarter of 2022 was 18.01, which was down from 19.95 for the first quarter of 2022. The median home price was $413,500 and the buyer CPL was $5.74.

This means that $1 in real estate lead generation leads to more than $18 in commissions. The median home price stood at $368,200 during the second quarter.

Using CINC's Q2 2022 Google Real Estate Buyer Cost Per Lead, Q2 2022 Median Home Price data from NAR, the average commission, and a conservative estimate of the percent of leads that close, CINC created the CINC Lead Value Index.

The Lead Value Index approximates the commissions that can be expected from a dollar in Google real estate advertising. [The formula is (the median home sales price times the average commission percentage times the average percent of leads that close) all divided by the total Google buyer CPL.]

California markets continue to lead the pack, with the highest home prices and competitive lead prices.

San Francisco and Sand Diego are the top two large markets and both have LVI's over 30.

These markets are followed by Boston, Miami, and New York. When the entire top 100 is considered, Honolulu remains the top market with an LVI of 51.

Of the top 25 largest markets, San Francisco (32.1), San Diego (31.8), and Boston (29.0) had the best lead value according to the Lead Value index. Detroit (11.5), Minneapolis (14.6), and Phoenix (14.8) had the lowest lead value.

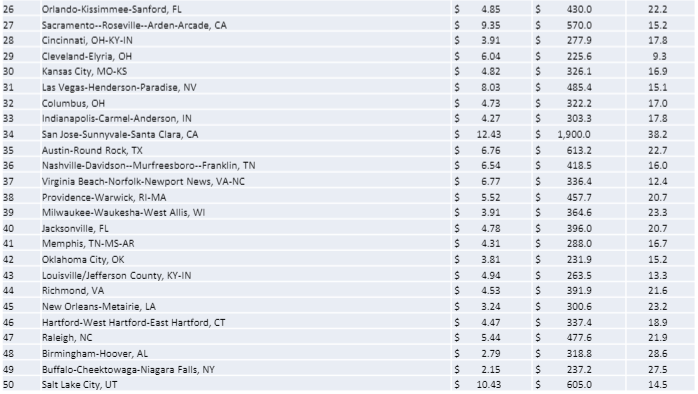

Of the 26th thru 50th largest markets, San Jose, CA (38.2), Birmingham, AL (28.6), and Buffalo, NY (27.5) had the best lead value according to the Lead Value index. Cleveland, OH (9.3), Virginia Beach, VA (12.4), and Louisville, KY (13.3) had the lowest lead value.

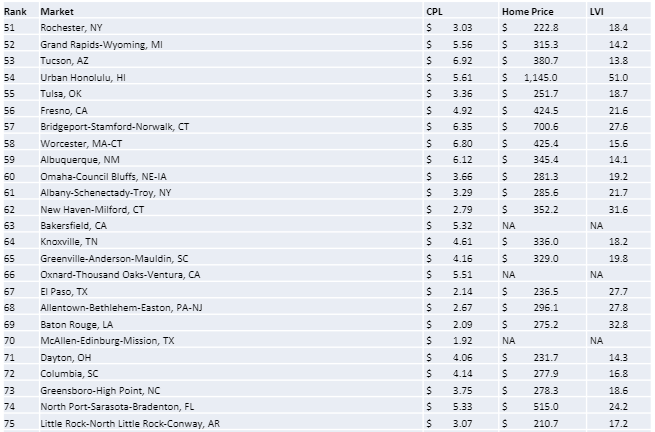

For 51st-75th largest markets, Honolulu, HI (51.0), Baton Rouge, LA (32.8), and New Haven, CT (31.6) had the best lead value according to the Lead Value index. Tucson, AZ (13.8), Albuquerque, NM (14.1), and Grand Rapids, MI (13.3) had the lowest lead value.

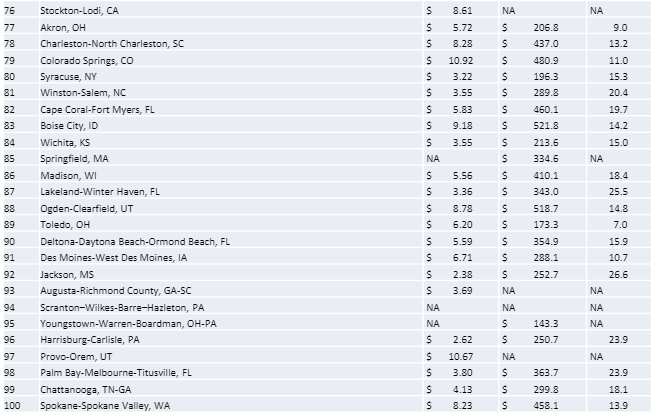

For 76th-100th largest markets, Jackson, MS (26.6), Lakeland, FL (25.5), and Melbourne, FL (23.9) had the best lead value according to the Lead Value index. Toledo, OH (7.0), Akron, OH (9.0), and Des Moines, IA (10.7) had the lowest lead value.

You can access the full detailed report here.

Additional Google Real Estate Lead Gen Resources from CINC:

With the real estate seller lead cost improving on Google in Q2, you can find incredible, cost efficient new seller lead opportunities in submarkets near you. Try our free Google targeting tool here to find hidden pockets of more cost effective hyper-local leads near you.

Watch our on-demand lead gen webinar from July here where we discuss new trends for real estate teams and agents on Google Ads, including a deep dive on Google Local Service Ads (LSA's) for realtors.

.png)

.png?width=770&name=Q2%202022%20Google%20Real%20Estate%20Lead%20Value%20Index%20(600%20%C3%97%20350%20px).png)